11% Decline in Worldwide Semiconductor Revenues by 2023

According to Alan Priestley, vice president Analyst at Gartner, this decline is one of the “worst declines in history”.

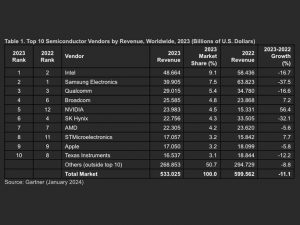

According to preliminary results from Gartner, Inc, worldwide semiconductor revenue in 2023 totaled $533 billion, representing a decline of 11.1% compared to 2022.

Alan Priestley, vice president analyst at Gartner, noted, “Although cyclicality in the semiconductor industry was present again in 2023, the market suffered a difficult year with memory revenues posting one of their worst declines in history.” Priestley also mentioned that market underperformance negatively affected several semiconductor suppliers, with only 9 of the top 25 experiencing revenue growth in 2023.

The combined revenue of the top 25 semiconductor suppliers declined by 14.1% in 2023, accounting for 74.4% of the market, compared to 77.2% in 2022.

Intel Regains Top Spot in 2023

Following the underperformance of memory suppliers in 2023, the ranking of the top 10 semiconductor suppliers changed year over year.

- Intel reclaimed the top spot from Samsung, after two years in second place. Intel’s revenue in 2023 totaled US$48.7 billion, while Samsung’s totaled US$39.9 billion.

- Nvidia’s semiconductor revenue grew by 56.4% in 2023, reaching $24 billion, pushing the company into the top five for the first time. This is due to its leading position in the artificial intelligence (AI) silicon market.

- STMicroelectronics moved up three places to secure the No. 8 spot, the same position it held in 2019. Its revenue increased 7.7% in 2023, driven primarily by a strong position in the automotive segment.

Memory Revenues Decreased 37% in 2023.

Revenues from memory products declined 37% in 2023, experiencing the largest decline of all segments in the semiconductor market. Joe Unsworth, VP Analyst at Gartner, noted, “Smartphones, PCs and servers, three of the largest segments for DRAM and NAND, faced weaker than expected demand and excess inventory in channels, especially in the first half of 2023.”

In 2023, DRAM revenue declined 38.5%, totaling $48.4 billion, and NAND flash revenue declined 37.5%, reaching $36.2 billion.

Non-Memory Revenues Decreased 3% in 2023

Non-memory revenue fared better and declined 3% in 2023. The market experienced weaker demand and excess channel inventory that negatively impacted the segment throughout the year.

Joe Unsworth, vice president analyst at Gartner, commented, “Unlike memory vendors, most non-memory vendors experienced a relatively benign pricing environment in 2023.” He added that demand for non-memory semiconductors for artificial intelligence applications was the strongest growth driver, with automotive (especially electric vehicles), defense and aerospace industries also outperforming most other application segments.