BNPL: Boosting Commerce in an Inflationary Environment

Amazon, Apple, and AliExpress have started to offer ‘Buy now, pay later’ (BNPL) solutions to their customers, allowing them to defer payment for their purchases. What does this formula consist of and what advantages does it offer?

According to the study ‘Buy Now Pay Later: Regulatory Frameworks, Competitor Leaderboard & Market Forecasts 2022-2027‘ by Juniper Research, consumer spending using ‘Buy now, pay later’ (BNPL) platforms will reach $437 billion by 2027. If forecasts are realized, the value of transactions paid for via BNPL will quadruple, as this year is expected to end with $112 billion in spending.

The consultancy explains that the rising cost of living will drive demand for this type of solution, which offers the possibility of paying for purchases in regular interest-free – or very low – installments, a particularly attractive option in the current inflationary climate. Companies such as Amazon, Apple, and AliExpress have already begun to explore its possibilities.

What is BNPL?

As its name suggests, it is a solution that allows deferred payment for purchases made by the consumer, whether in an online or physical environment. The report ‘The Deloitte and Mambu guide to Buy Now, Pay Later‘ defines BNPL as follows: “It is a short-term financing option that allows customers to buy products and pay for them in the future, at zero or low interest. Payment schedules depend on the terms offered by the BNPL provider, but typically include payment in full at the end of the month, payment in three installments (three equal monthly payments), or payment in four installments (four equal bi-weekly payments)”.

Ángel Cuenca, Head of CoE Medios de Pago at Babel, points out that BNPL is “halfway between a means of payment and financing”. “It is a way of consuming and paying in a flexible way, by delaying payment over several installments, usually three or four. But unlike classic financing, this flexible payment method does not usually have a higher cost for the user, with the cost of the operation being shared between the merchant and the financier,” he specifies.

In reality, this is nothing new, as it is a model that has been around for a long time. “It’s the same thing that used to be done in department stores: linking financing to the sales process, automatically, to increase sales and the average ticket. To do this, we use all the capabilities that technology now provides, so that the purchase and financing process is quick and transparent for the consumer,” explains Jaime Marín, Fiizy‘s director of business development in Spain. In this way, what is new is the application of technology, which makes it possible to offer this payment facility in a simple way, extending its possibilities of use.

Advantages for consumers…

Cuenca points out that flexibility is the biggest benefit that the BNPL offers to the buyer. “The consumer can buy now and decide when to pay,” he says. Marín also highlights the decision-making power that this method provides. “The consumer is the one who decides how he wants to pay for the purchase, as he can choose in how many installments, so he buys according to what he can afford to pay each month.

![]()

In addition, the head of Babel stresses that the operating costs of these microcredits are usually borne by the businesses and financiers, “who adjust their margins in favor of obtaining greater transactionality”, he points out. Thus, as it is usually offered interest-free, the consumer does not see the final cost of their purchase increase, which is the case with conventional financing.

…For sellers…

At the same time, BNPL offers multiple benefits to the buyer. “It facilitates the purchase decision and thus the conversion, as well as the increase of the average ticket, which is the main advantage for the retailer. Consumer statistics show that retailers who offer flexible payment methods increase their conversion rates by 20-30%. And having the option of deferred payment usually has a positive influence when it comes to including an additional product that completes the purchase and, therefore, increases the average ticket,” Cuenca explains.

On the other hand, when a customer uses the BNPL, it generates financial behavior data. This can be used to personalize the offer of products and services, responding better to the interests and particular situations of each user.

Babel’s Head of CoE Payment Media also emphasizes that “flexible payment tools fit perfectly into the customer journey, minimizing friction at the time of payment, which helps to increase consumption”.

It also states that “the customer or end-user has a greater engagement with the brand or business that offers BNPL”, which translates into loyalty, increasing the likelihood of repeat purchases in the same establishment or to hire a service again.

Furthermore, although retail is the sector that can benefit most from the implementation of BNPL, its use is not limited to retail. “It can be used in any sector and for any purchase amount,” says the Fiizy manager. “These formulas are also very well received in other cases, such as travel, major repairs, or even for energy bills in the colder months, now that winter is coming,” says Cuenca.

…And for suppliers

The development of the BNPL also brings new business opportunities for suppliers of this type of solution. “They are eminently digital instruments that involve different economic agents, both financial – banks, credit companies or fintech – and technology and digital transformation companies,” says the Babel spokesperson.

Thus, Marín points out that “there is a mix of providers”, whether they are banks, traditional consumer finance companies, or fintechs. And there are also opportunities such as Fiizy, “a multi-financial BNPL platform, which connects consumers with different financial institutions in order to access the best financing option at the moment”, he explains.

BNPL providers earn their revenue from the commissions paid by merchants for financing the transaction. The seller can pass this cost on to the end customer, in the form of interest. However, they can also offer this option interest-free. “We offer the possibility for the retailer to campaign to his customers by offering 0% interest. It is the retailer himself who takes care of the financing costs so that the customer does not pay interest”, says the Fiizy manager.

On the other hand, Cuenca explains that “suppliers focus their benefits on attracting customers, with whom they can cross-sell other products, and on the exponential increase in transactions: many operations with a small profit”.

How does it work?

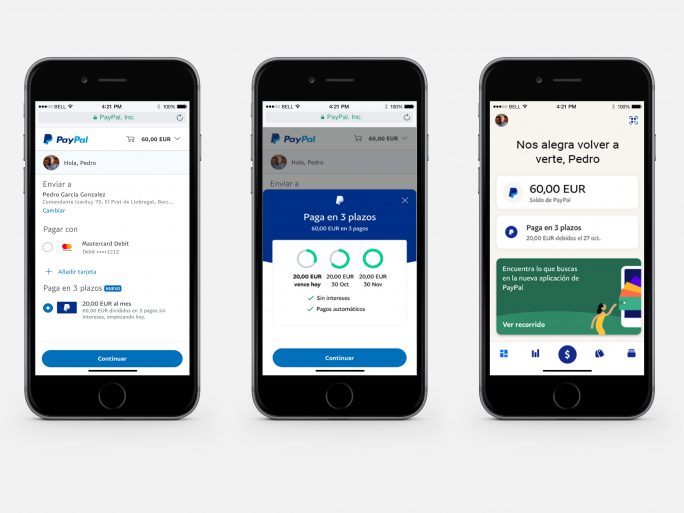

Cuenca explains that “BNPL solutions are integrated into the sales flow”. “If we are talking about digital commerce, they are integrated into the check out when selecting the payment method. And if we talk about physical commerce, through a link or QR”, he specifies.

Marín assures that “the integration of the BNPL service is very simple”. “Depending on the e-commerce platform, we have plugins or connectors that can have the service integrated in less than an hour. Additionally, we have our own API for merchants to integrate into an assisted process with our technicians. And we are also included in the Prestashop catalogue”, he specifies.

In addition, the Babel manager emphasizes that “we are talking about very simple processes, which minimize friction at the time of payment, requiring very little data from the user”. “The success of these solutions is to balance risk and the sales flow or customer journey. The right design of the user experience is key for BNPL solutions to meet their objective of increasing sales, as well as the automation of operational processes that reduce costs,” he adds.

![]()

Risk selection must also be taken into account. “As a multi-entity platform, we have an algorithm that selects the financial institution with the highest probability of conversion for the customer based on their shopping cart data. The decision is made in real-time, once the customer completes the application,” specifies Marín.

Another important aspect is fraud prevention. “Each entity uses its own process. Normally, a photo of the ID card and a selfie are requested to ensure that the person applying for financing is really the person who appears on the ID card. In other cases, bank data reading techniques, authorized by the payment directive, are used to validate the ability to pay and the identity of the account holder. In addition, the financing contract is signed on the customer’s computer or mobile phone by means of an electronic signature process, a process that is also regulated in Spain”, explains the Fiizy spokesman.

Likewise, Cuenta stresses that in each step of the contracting process “standards can and should be applied to prevent fraud or rogue traders, from reliable identity recognition to applying rules to identify risky transactions by applying machine learning”. In any case, he notes that BNPL transactions tend to have “a relatively small purchase ticket, which also implies a moderate risk”.

Implementation in Europe and Spain

According to ‘The global payments report‘, prepared by Worldpay, BNPL accounted for 2.9% of the total value of global eCommerce transactions in 2021. And the share is expected to rise to 5.3% by 2025. It further notes that BNPL solutions will account for 1.6% of point-of-sale turnover in three years’ time, although they accounted for less than 1% in 2021.

The BNPL situation in Europe is above the global average, as it accounted for 8.1% of eCommerce spending in 2021, with expected growth to 12% by 2025. Its use in the Nordic countries stands out, with Sweden leading the way (25.2% of eCommerce transaction value), ahead of Norway (18.1%), Finland (12.8%), and Denmark (11.7%). It is also well established in Germany (19.7%).

Furthermore, the study shows that Europeans are more attracted to the use of BNPL in physical shops. If the value of BNPL transactions at the point of sale represented 1.9% in 2021, it is expected to reach 2.8% by 2025, when the share of BNPL is expected to exceed 5% in Denmark, Germany, Sweden, and the UK.

In addition, the report reveals that the global leaders are Klarna, Afterpay, and PayPal, ahead of Zip, Sezzle, and other smaller local competitors. Sweden’s Klara is particularly prominent in Europe, due to its dominance in the Nordic market.

In the case of Spain, the Worldpay report indicates that BNPL represents around 2% of the value of eCommerce transactions. According to data from the ‘Buy Now Pay Later Market Country Reports, 2021’ study by Research and Markets, included in the Deloitte and Mambu report cited at the beginning of the report, the value of transactions paid for in eCommerce using BNPL in Spain will stand at 3,520 million dollars in 2022. And it forecasts that this amount will increase fourfold over the next six years, reaching 13,351 million in 2028, with an average annual growth of 24.9%.

In any case, there is still a long way to go, as BNPL is a long way behind the most widely used means of payment for online purchases in Spain, where mobile/digital wallet solutions such as PayPal, BBVA Wallet and Apple Pay stand out (30.3% of the value of transactions), ahead of credit card payments (28.3%) and debit card payments (18.5%) or transfers (15.3%), as shown in the Worldpay study.